Venture Investment Reaches KRW 8.6 Trillion; Fund Formation Hits KRW 8.2 Trillion from the First to Third Quarters of 2024

- Division

- Spokesperson's Office

- Date

- 2024.11.15

- Writer

- MSS

- Headline

FOR IMMEDIATE RELEASE

Nov. 15, 2024

Venture Investment Reaches KRW 8.6 Trillion; Fund Formation Hits KRW 8.2 Trillion from the First to Third Quarters of 2024

On November 14, 2024, the Ministry of SMEs and Startups (MSS) released the report on the trends in domestic venture investment and fund formation for the third quarter of 2024.

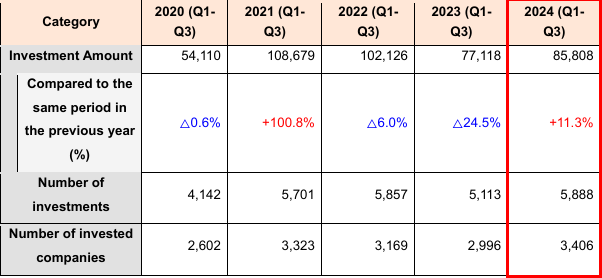

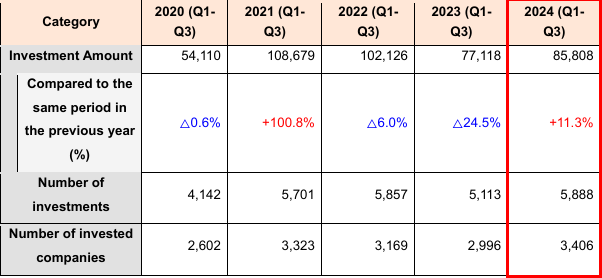

Cumulative venture investment for the third quarters of 2024 reached KRW 8.6 trillion, reflecting an 11.3% increase compared to the same period in 2023. This growth suggests that venture investment, which had been subdued due to a challenging financial environment marked by high interest rates, is now entering a phase of stable recovery.

Minister Oh Youngju said, “Venture investment in Korea continues to grow steadily, even amid a challenging global economic environment.” She added, “With the implementation of the ‘Advanced Venture Investment Market Leap Strategy,’ announced on October 2, we will accelerate this growth and build a world-class venture investment ecosystem.”

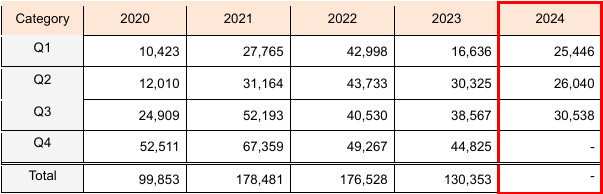

Venture Investment Trends Over the Past 5 Years

(Unit: KRW 100 million, Number of Cases, Number of Companies)

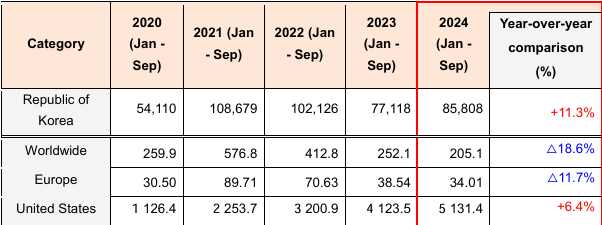

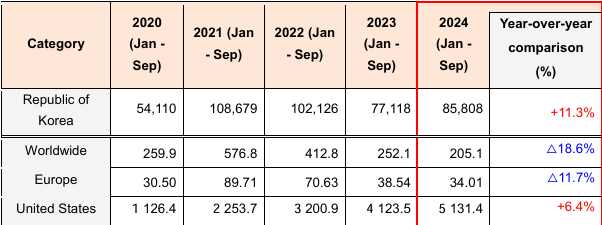

Global venture investment declined by 18.6% compared to the previous year, with Europe experiencing a 11.7% decrease, while the United States saw a 6.4% increase. In contrast, Korea's venture investment figures remained relatively strong, outperforming global trends.

Global Venture Investment Trends Over the Last 5 Years

(Unit: KRW 100 million, USD 1 Billion)

In terms of sector investments, ICT services and Electrical, Machinery, and Equipment have seen significant growth compared to the previous year, with increases of 46.8% and 24.4%, respectively, driving the overall expansion of venture investments.

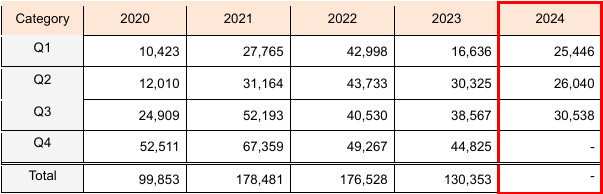

The total fund formation for the first three quarters of 2024 reached KRW 8.2 trillion, reflecting a 4.1% decline compared to the same period in 2023. However, there has been a positive trend in fund formation, with amounts rising for two consecutive quarters—from KRW 2.5 trillion in the first quarter to KRW 3.1 trillion in the third quarter.

Quarterly Fund Formation Trends Over the Last 5 Years

(Unit: KRW 100 Million)

Nov. 15, 2024

Venture Investment Reaches KRW 8.6 Trillion; Fund Formation Hits KRW 8.2 Trillion from the First to Third Quarters of 2024

On November 14, 2024, the Ministry of SMEs and Startups (MSS) released the report on the trends in domestic venture investment and fund formation for the third quarter of 2024.

Cumulative venture investment for the third quarters of 2024 reached KRW 8.6 trillion, reflecting an 11.3% increase compared to the same period in 2023. This growth suggests that venture investment, which had been subdued due to a challenging financial environment marked by high interest rates, is now entering a phase of stable recovery.

Minister Oh Youngju said, “Venture investment in Korea continues to grow steadily, even amid a challenging global economic environment.” She added, “With the implementation of the ‘Advanced Venture Investment Market Leap Strategy,’ announced on October 2, we will accelerate this growth and build a world-class venture investment ecosystem.”

Venture Investment Trends Over the Past 5 Years

(Unit: KRW 100 million, Number of Cases, Number of Companies)

Global venture investment declined by 18.6% compared to the previous year, with Europe experiencing a 11.7% decrease, while the United States saw a 6.4% increase. In contrast, Korea's venture investment figures remained relatively strong, outperforming global trends.

Global Venture Investment Trends Over the Last 5 Years

(Unit: KRW 100 million, USD 1 Billion)

In terms of sector investments, ICT services and Electrical, Machinery, and Equipment have seen significant growth compared to the previous year, with increases of 46.8% and 24.4%, respectively, driving the overall expansion of venture investments.

The total fund formation for the first three quarters of 2024 reached KRW 8.2 trillion, reflecting a 4.1% decline compared to the same period in 2023. However, there has been a positive trend in fund formation, with amounts rising for two consecutive quarters—from KRW 2.5 trillion in the first quarter to KRW 3.1 trillion in the third quarter.

Quarterly Fund Formation Trends Over the Last 5 Years

(Unit: KRW 100 Million)